主题:房地产行业如何通过区块链+的发展实现数字化、智慧化转型 How can the real estate industry realize digital and intelligent transformation through the development of blockchain + 时间:2021年2月3日 20:00 Time:February?3rd,2021 主讲: 魏然 地产科技平台UPRETS?CMO,世界经济论坛全球杰出青年北京社区媒体官。曾任八维资本投研总监,DAOONE社区联合创始人。魏然是硅谷Draper?University校友,2021级清华-康奈尔金融MBA。巴比特专栏作家,专栏阅读量达270万。UPRETS是纽交所上市地产集团鑫苑(NYSE:XIN)旗下的地产科技平台,拥有合规数字证券发行,DeFi借贷协议和链下数据预言机等核心产品,致力于将实体资产纳入去中心化金融(DeFi)世界。 Ran?Wei Ran is the CMO of UPRETS, a platform backed by real estate conglomerate NYSE:XIN which simplifies investment by advising on and digitalizing securities. She is the media officer of World Economic Forum Global Shapers Community Beijing Hub and was the Director of Research of 8 Decimal Capital. As a passionate evangelist of blockchain, Ran has participated in the creation of several books and is a freelancer on?8BTC.com. Ran graduated from UIBE, received entrepreneurship training in Draper University in Silicon Valley, and is an incoming Cornell-Tsinghua MBA candidate. RICO 彭岦囯 圣德穆Sanctum资本联合创始人,全球区块链机构联盟GBO创始成员及执行董事 他是多家全球风投机构的GP及LP,并在国际数字经济,区块链峰会、智慧城市等高科技行业会议多次被邀请演讲嘉宾。 Hi,大家好,欢迎来到圣德穆中文社区的AMA 本期的主题是《房地产行业如何通过区块链+的发展实现数字化、智慧化转型》,我是本次的主持人圣德穆首席客服官?。 首先,欢迎下我们的嘉宾魏然魏总、RICO 彭岦囯, 请魏然魏总简单介绍下自己 请RICO 彭岦囯简单介绍下自己 现在开始我们今天的对话环节,如果你们有什么问题可以在AMA结束后提问。 1、?如何看待区块链+的发展? 1.?How do you think?about?the development of blockchain+? 魏然: 我之前写过一篇文章,叫《区块链的第三波浪潮》。从金融的角度看,第一轮浪潮开启于支付转账,09年起,比特币作为一种支付工具,颠覆了必须依赖传统金融机构才能支付转账的模式。诞生于08年经济危机后的比特币呼应了人们对传统金融系统的不满不忿,兴起了一波“去中心化”的思潮。 I’ve written an article before called “Three waves of Blockchain revolution in Finance”. Throughout the life of blockchain, the industry has experienced several waves. The first wave started with payment & transactions when Bitcoin became popular payment tools. These new currencies disrupted the payments space, which previously only relied on traditional financial institutions. Bitcoin, born after the 2008 economic crisis, echoed people’s discontent with the traditional financial system, launching a new wave of “decentralized” thinking. 第二轮浪潮开启于股权融资,以太坊的诞生让ERC20 Tokens的发行极其简单,基于其实现的ICO,本质上是一种新的股权融资方式,同时在“牛市”行情里,给风投机构提供了一种回报率和流动性都极高的退出方式。当监管滞后和缺位时,少量项目可以面向全球投资者进行无门槛的股权众筹,那时,项目供给远远小于投资需求,百倍千倍的回报率也在情理之中,这就是所谓“泡沫”的来由。 The second wave was equity and financing, when Initial Coin Offering and the issuance of ERC20 tokens became the new means of funding blockchain projects.?During the 2017 bull market, token investments gave venture capital funds an exit opportunity providing a high liquidity and rate of return. Amid the regulatory uncertainty, ICOs surged due to getting funding from many hyped investors. As a result, a hundred times return on an investment became “reasonable,” giving cause to the “bubble.” 第三轮浪潮就是区块链和广义的金融衍生品市场结合,DeFi的火爆一部分就来源于金融工具的丰富和创新。全球固收市场的规模是股权市场的3倍左右,截至2020年8月就达128万亿美金,在区块链金融里也是同理,从数字资产现货交易到借贷(MakerDAO,Compound,Aave),交易(Uniswap,Sushiswap)再到聚合(1inch),合成资产(Sythetix,Linear)和保险(Nexus?Mutual),再及利率衍生品(Benchmark),证券化(UPRETS,BarnBridge),期权期货产品(Derebit)等,我们看到原生数字资产的衍生品正在崛起。 The third wave is DeFi, the combination of Blockchain technology and financial derivatives.?With the development of many more sophisticated financial instruments,?the Decentralized Financial market witnessed a hype during the last year. For instance, till August, 2020, the size of fixed income market reached 128 trillion USD, which is around triple the size of equity market. Similarly, in the crypto world, we’ve seen the emergence of lending protocols( MakerDAO,Compound,Aave), DEX trading(Uniswap,Sushiswap) ,aggregator(1inch), synthetic assets(synthetic, linear) ,insurance(Nexus?Mutual) ,securitization(UPRETS, BarnBridge), Options and Futures(Derebit). Those financial innovations would significantly enlarge the market size of crypto space. RICO: Blockchain as a technology has received wide adoption across private sectors about about 20 years ago. Bitcoin being the most successful experiment and strived to be one of the fastest growing store of value asset in the history of mankind. Recent years, WEF started to promote its Industrialization 4.0, much more attention was given to the Blockchain protocol . One of the top advocate for amongst all the governments was China & USA. President Xi has advocate in speeding up the adoption of Blockchain to ensure a top bottom execution across all government levels.?In 2016, the Ministry of Industry and Information Technology (MIIT) issued a blockchain white paper that discussed use cases for the technology, including the Internet of Things, the supply chain and digital assets. Later that year, China’s State Council, or cabinet, included blockchain as part of the five-year plan for the information industry that ends in 2020. Today, the digital renminbi (RMB) or the yuan, a virtual currency administered by the People's Bank of China (PBOC), the country's central bank, has arrived in full in Shanghai.?Many economies worldwide are exploring digital currencies, for example, in Switzerland, Singapore and Canada, and especially in northern Europe are following China’s foot steps. All of these would not be possible without the blockchain technology. Sanctum has been providing consulting and advises several governments over the last 10 years in advocating towards the adoption of Blockchain Technology. This year, Sanctum will be working on more DeFi & NFT initiatives. My co-founder Dunstan Teo has co-authored a book titled “The Bitcoin Dystopia: The Prelude” in May 2019. He has been involved in the Bitcoin network since the very beginning as a professional gamer and miner, he has shared a number of insights of many happenings globally via a sci-fi manner. I hope more of you will read and understands better where Sanctum is coming from and where we are hoping to achieve in the future with our collective efforts. It’s a movement for the mankind and everyone can be part of it. Sanctum will continue to strive towards our grand vision in bringing more wealth sovereignty and freedom to people. Please stay tuned to some of the latest development through our Global Community Group Chats. It’s my pleasure to have Wei Ran, CMO of UPRETS to join us today to share some of the latest development in Real Estate and land assets digital transformation. We have known each other for years and look forward to bring more positive changes into this space together. 区块链作为一项技术,在大约20年前就已被私营部门广泛采用。比特币是最成功的实验,并努力成为人类历史上增长最快的价值存储资产之一。 近年来,世界经济论坛开始推进工业化4.0,区块链协议受到越来越多的关注。在所有政府中,中国和美国是最主要的倡导者之一。 习主席提倡加快区块链的采用,以确保各级政府自上而下的执行。2016年,工业和信息化部发布了区块链白皮书,讨论了该技术的用例,包括物联网、供应链和数字资产。当年晚些时候,中国国务院将区块链列为2020年结束的信息产业五年计划的一部分。 今天,数字人民币(RMB)或人民币,一种由中国人民银行(PBOC)管理的虚拟货币,中国的中央银行,已经全面抵达上海。世界上许多经济体都在探索数字货币,例如,瑞士、新加坡和加拿大,特别是北欧国家正在追随中国的脚步。如果没有区块链技术,这一切都不可能实现。 在过去10年里,Sanctum一直在为几个国家的政府提供咨询和建议,倡导采用区块链技术。今年,Sanctum将致力于更多的DeFi和NFT项目。 我的联合创始人邓斯坦·特奥(Dunstan Teo)于2019年5月与人合著了一本书,名为《比特币反乌托邦:序曲》(The Bitcoin Dystopia: The Prelude)。他从一开始就作为一名职业玩家和矿工参与比特币网络,他通过科幻的方式分享了许多全球发生的事件的见解。我希望你们中有更多的人能够阅读并更好地理解Sanctum的由来以及我们希望通过共同努力在未来实现的目标。这是一场全人类的运动,每个人都可以参与其中。 Sanctum将继续努力实现我们的宏伟愿景,为人民带来更多的财富、主权和自由。请通过我们的全球社区群聊继续关注最新的发展。 今天很高兴能请到upprets的CMO Wei Ran来与我们分享一些房地产和土地资产数字化转型的最新进展。我们已经相识多年,希望能一起为这个领域带来更多积极的变化。 2、在 2019 年初,多项预测曾表示「2019 年将是数字证券发行元年」。这一年中,无论是监管框架逐完善的美国、欧洲等地,还是对数字资产展示兴趣的亚洲、澳洲等地,数字证券都成为了传统行业与新兴技术的交点,稳步发展。 那么,如今,你是如何看待数字证券发行的? 2. In early 2019, a number of forecasts indicated that "2019 will be the first year of digital securities issuance". In this year, no matter in the United States and Europe where the regulatory framework is gradually improved, or in Asia and Australia where they are interested in displaying digital assets, digital securities have become the intersection of traditional industries and emerging technologies, and developed steadily. Now, what do you think of the issue of digital securities? RICO: Sanctum has been involved in developing a number of digital securities ventures and overall architecture design, including the VIE structure for risk management purpose since 2019. One of our client was listed on a FCA regulated exchange with their security token. We worked with many SEC, FCA & FINRA regulated exchanges to list our partner & client’s projects. I reckon there will be more stricter regulations around digital securities moving forward. We are lobbying with FATF, SEC, FINRA & many other governments Securities Commissions in their openness towards adopting digitization of assets and it’s policies around it. Our technology is ready for it, however there are too much risk for projects to embark on the journey without a clear guidelines and regulations to be adhered too. This is one of the challenge that we are facing in this industry. Education and awareness isn’t enough too in many countries! Most entrepreneurs do not understand how the technology could optimise and change people’s lifestyle including behavior change. China is one of the great example where it has successfully enabled digital payment systems across 60% of the population where most part of the world are still trying to emplement 20% of what China has achieved. China entrepreneurs are having problems to duplicate their business to overseas markets and we saw many projects were not properly regulated. The projects need to have local partners and to work with regulators to let them understand the benefits, rather than take them as a risk. 自2019年以来,anctum一直参与开发多个数字证券项目和总体架构设计,包括用于风险管理的VIE结构。我们的一个客户在FCA监管的交易所上市,其证券代币。我们与许多受SEC、FCA和FINRA监管的交易所合作,让我们的合作伙伴和客户的项目上市。 我认为未来会有更严格的数字证券监管。我们正在与FATF、SEC、FINRA和许多其他政府证券委员会进行游说,以表明他们对采用资产数字化及其相关政策的开放态度。 我们的技术已经为它做好了准备,但是,如果没有一个明确的指导方针和规则来遵守,那么项目就会有太多的风险。这是我们在这个行业面临的挑战之一。 在许多国家,教育和意识还不够!大多数企业家不明白科技如何优化和改变人们的生活方式,包括行为改变。中国是一个很好的例子,它成功地使数字支付系统覆盖了60%的人口,而世界上大部分地区仍在努力实现中国所取得成就的20%。 中国企业家在向海外市场复制他们的业务方面遇到了一些问题,我们看到许多项目没有得到适当的监管。这些项目需要有当地的合作伙伴,并与监管机构合作,让他们了解这些项目的好处,而不是把它们当作风险。 魏然: 2021年,数字资产市场的体量已经到达近1万亿美金,DeFi(去中心化金融)市场规模达137亿美金,美金稳定币市场规模峰值达387亿美金。而全球数字证券市场的市场份额仅占1亿美金。可见,实体资产与区块链世界仍未跨越鸿沟,实体资产和证券数字化的基础设施仍在搭建,一个极大的蓝海市场尚待挖掘。 从资产端来看,仅看地产行业,根据《The Business Research》 统计,2021年全球存量地产资产规模将达277万亿美金,根据MSCI 统计,地产投资规模跃升到10万亿美金,全球REITs市场规模则在3.5万亿美金左右 。从资金端来看,尽管COVID-19期间,美联储接连降息,美国房企的融资成本较低,但在中国,由于针对地产行业的“三条红线”等政策因素,拥有境外资产的中资房企拓宽新型融资需求的诉求非常迫切。美金稳定币市值的激增和DeFi借贷市场的崛起,为传统企业融资提供了一条潜在的更低成本的解决方案。 另一方面,目前的DeFi世界,主流的抵押物仍局限于BTC、ETH等价格波动剧烈的数字资产,一方面,由于数字资产市场市值仍不到一万亿美金,抵押品的增长潜力有限,另一方面,尽管数字资产流动性极强,但2020年我们经历的是牛市的上行周期,当市场转入必然出现的熊市,抵押物暴跌时,DeFi项目的TVL会大幅缩减,触发清算,又带动DeFi治理币的下跌,对市场造成一系列不可知和多米诺骨牌似的风险。 数字资产和实体资产,在定价、确权、清算、治理体系等方面有很多不同。实体资产的劣势很明显,比如流动性差,定价难,产权转移流程复杂,但也有很多优势,比如较为稳妥的价格,更大的体量和真实的现金流。将实体资产纳入抵押品是DeFi扩容和可持续发展不可或缺的一步。 目前,区块链世界纯链上的价格抓取方式如预言机,清算和实时拍卖机制,以及基于公链和地址的产权转移还不能完全适用于实体资产如地产。我们需要和各方,包括监管者、律师、区块链行业和金融领域的头部企业等共同探索一条结合了链上和链下,中心化和去中心化的解决方案。 In 2021, the volume of the digital asset market has reached nearly US$1 trillion, the DeFi (decentralized finance) market has reached US$13.7 billion, and the US dollar stablecoin market has peaked at US$38.7 billion. The market share of the global digital securities market is only 100 million US dollars. It can be seen that physical assets and the blockchain world have not yet crossed the adoption?gap, the digital infrastructure for physical assets and securities is still being built, and a huge blue ocean market has yet to be tapped. From the asset side, just look at the real estate industry. According to statistics from "The Business Research", the market?size of global real estate assets will reach US$277 trillion in 2021. According to MSCI statistics, the scale of real estate investment has jumped to US$10 trillion and that of the global REITs market is around US$3.5 trillion. From a capital perspective, although the Federal Reserve has cut interest rates successively during COVID-19, the financing costs of US real estate companies are lower, but in China, due to policy factors such as the "three red lines" for the real estate industry, Chinese real estate companies with overseas assets have an urgent demand to broaden into new financing. The surge in the market value of the US dollar stablecoin and the rise of the DeFi lending market provide a potentially lower-cost solution for traditional corporate financing. On the other hand, in the current DeFi world, mainstream collaterals are still limited to digital assets with violent price fluctuations such as BTC and ETH. Since the market value of the digital asset market is still less than US$1 trillion, the growth potential of collateral is limited. Despite the extremely strong liquidity of digital assets, we will experience an upward cycle with a 2020 bull market. When the market turns into an inevitable bear market and the collateral plummets, the TVL of the DeFi projects?will be greatly reduced, triggering liquidation, and driven by the decline of DeFi governance coins, it triggers a series of unknowable and domino-like risks to the market. There are many differences between digital assets and physical assets in terms of pricing, confirmation of ownership/rights, liquidation, and governance systems. The disadvantages of physical assets are obvious, such as poor liquidity, difficult pricing, and complicated property rights transfer processes, but they also have many advantages, such as relatively stable prices, larger volumes, and real cash flow. Incorporating physical assets into collateral is an indispensable step for DeFi expansion and sustainable development. At present, the price capture methods on the pure chain of the blockchain world, such as oracles, clearing and real-time auction mechanisms, as well as the transfer of property rights based on public chains and addresses, are not yet fully applicable to physical assets such as real estate. We need to work with all parties, including regulators, lawyers, leading companies in the blockchain industry and the financial sector, to explore a solution that combines on-chain and off-chain, centralization and decentralization. 3、在传统的房地行业中,对于房产商来说,负债率事一把双刃剑,有负债说明有投资,但是负债率高又影响到企业的风险承担能力,你是如何看待的呢? 3.In the traditional real estate industry, for real estate developers, the debt ratio is a double-edged sword. If there is debt, there is investment. But the high debt ratio affects the enterprise's risk-taking ability. What do you think of it? 魏然魏总: 对于房产商来说,没有负债就表示没有杠杆化的投资,资金利用率就不够高。而房产商存在去「播种」的需求,有去买被低估的资产的需求。这种情况下, 其动机并非是单纯的「缺钱需要融资」或单纯的「资产质地不好」,已经拥有了优良资产的房产商们一直在寻求「通过更具流动性的方式去投资目前被低估的资产」 我曾经写过一篇文章叫《金字塔式撒钱》(https://www.sohu.com/a/213262115_456269)。本质上,“信用”和“房地产”是相互捆绑的,银行信贷都是刚兑的,会不断增加负债端的规模,信贷扩张和房价上涨相互促进,共同推动一个“繁荣”进程。按照明斯基的理论,投资者分三类,对冲性、投机性和庞氏性融资者。对冲性融资者每个时期的现金收入都能偿付该期的本金和利息。对投机性融资者来说,其每期收入的现金能够偿付利息,但不一定能够偿付本金。而庞氏融资者,每期的现金流收入不但无法偿还到期本金,连利息都无法偿付。它不但要债务展期,还要出售资产或者新增借款来支付利息。反映在资产负债表上,就是增加了债务,减少了股权价值,提高了杠杆率。 由于股权融资者并不承诺偿付本金,所以股权融资比例越高,越偏向对冲性。商业银行一般需要利用短期融资为长期头寸融资,玩的是短借长还,属于投机性融资者。而房企,大部分是高杠杆运作的。房价上涨后,以房子作为抵押物可以借到更多的钱,借来的钱再次投入房产。渐渐的,从市场上借来的钱持续流入房地产,其他行业的投资遭到挤压,房价被不断推升;当房价高到需要整个家庭为此紧衣缩食的时候,消费力和内需也在衰减。于是,从银行借来的钱通过各种通道源源不断的涌向唯一几个能赚钱的领域,进一步推高风险资产价格。 08-18年,我们迎来了房地产市场与金融市场的繁荣期。在依靠银行信用投放货币的模式下,首先受益的是地方融资平台、国企和房地产企业,其中,房地产作为信贷的抵押品,呈现过度扩张的现象。近些年,地方债务和房地产的债务逐渐到期带来巨大的资金压力,而银行又受限于监管,无法继续向这些领域投放资金,资金链便很容易断裂。于是,便诞生了银行的影子来代司其职。影子化的信用创造链条可以表述为:“中央银行—大型商业银行和广义基金—同业存单—中小商行—同业理财—委外投资—二级市场或实体项目”。

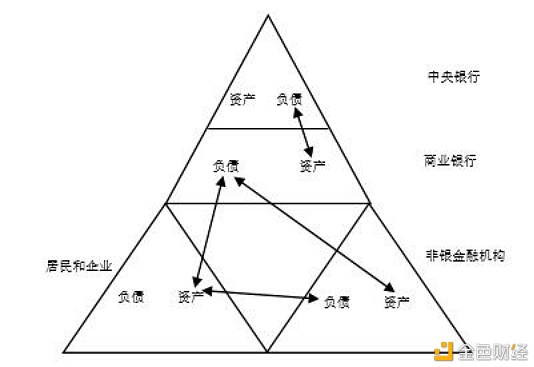

货币的发行也是一条供应链,而且是金字塔形的,在不同层级融资成本是不同的。利率就是借钱的成本,就是钱的价格。房产企业原来可以从商业银行表内借款,后来可以从非银机构以非标形式借款,甚至以P2P形式线上借款,海外发美元债借款,做科技业务到资本市场募资。但到今年,无论哪种渠道都收紧了。所以房企的负债率高企,而且很难再融到低成本的资金,再投资就会变得非常困难。 4、房地产与前沿科技和金融工具的结合逐步形成了一种发展趋势,无可避免,那么你觉得区块链应该如何帮助房地产? 4. The combination of real estate with cutting-edge technology and financial tools has gradually formed a development trend, which is inevitable. How do you think blockchain should help real estate? 魏然魏总: 我一直觉得我们需要探索一个“乾坤大挪移”的方案。可以让传统的老钱将资产配置到新兴资产上来。而老钱不一定是以现金的形式直接购买数字资产,也可以是以资产的形式投资于数字资产。 老钱(Old Money)是几十年甚至百年前从金矿、地产、石油、零售等传统行业里或股票、债权、期货等传统资本市场里摸爬滚打的赚得的。在这个时代,数据就是石油,Token就是金矿,存储就是地产,通信协议就是高速公路,交易所就是纳斯达克。尽管它们在线下不可见,不可摸,不存在具象的物质实体,却正因为它们轻盈、虚拟的特性,可以跨越时空的束缚,每周7天,每天24小时的无缝运转,让全世界的资产实现高速率的流动和无摩擦的互换。 比如缺乏流动性的地产资产,先变成类REIT的金融产品,结合区块链技术变成可分割和更小单位的标准化投资工具,和数字资产形成交易对,在二级市场或DEX上进行交易,这种方式可以帮助“老钱”盘活自己的存量资产。 房地产行业有两个大的趋势。首先是时间上的拉长,房地产在过去一直是以粗犷、简单的方式进行建设和销售,而现在已转变成了集合商业运营、物业管理等为一体的综合化业务,卖不出去的房子需要盘活,在这过程中又衍生出了REITs等一系列解决方案。 其次是空间维度的上升,房地产从最初钢筋混凝土这样的线下物质空间,逐渐上升到了线上空间维度,数据、用户和算法成为最重要的因素。区块链作为一项应用于数据确权和溯源的技术,在这样的背景下就显得尤为重要。 5、UPRETS是房地产资产通证化平台,能详细介绍下UPRETS项目吗? 5. Uprets is a real estate asset certification platform. Can you introduce the project of uprets in detail? 魏然魏总: UPRETS,作为背靠纽交所上市地产公司鑫苑集团(NYSE:XIN)的金融科技企业,天生拥有地产和科技的双重基因,既有地产行业20余年的产业资源,同时也有5年多的区块链技术开发和产业应用的探索和沉淀。 我们一直认为,对地产行业来说,数字化转型是必然趋势,数据会成为比实物更珍贵,更有价值的资产,而区块链行业要想长远发展,一定也需要和实体经济相结合,我们想扮演让实体资产数字化,进入DeFi生态的桥梁。 目前,UPRETS的产品线包含数字证券发行、DeFi抵押和借贷和技术基础设施三个主要方面, 1)数字证券方面,UPRETS成功发行了世界首个在二级市场上架交易的地产数字证券,2020年3月,完成了美国纽约东河湾Oosten项目的一级市场募资(RegS),2020年6月,完成了数字证券的技术发行(OST,适用于Xbolt联盟链,以太坊和比特币Omni等主流协议),并在二级市场——塞舌尔的证券交易所MERJ登录交易。同时,我们也将继续服务于鑫苑国际价值数亿美金的自有地产项目,和价值达数十亿美金的外部合作项目,提供从咨询、架构设计、技术发行到二级交易的全流程辅导; 2)DeFi抵押和借贷,UPRETS正在密切的和主流公链上的头部DeFi项目建立合作,为DeFi的抵押池贡献更多优质的基于实体资产的数字证券。 1.我们和以太坊上最大的稳定币生态MakerDAO社区紧密合作,成为RWA工作组的创始成员,与德国的企业如Centrifuge、美国的地产基金Resolute.fund合作,计划将优先级贷款纳入DAI抵押池,在2021年6月申请到DAI针对实体产业的数亿美金的信贷额度。 2.我们也在和更多公链生态,比如币安智能链、本体、NEO、波卡生态等密切合作。19年我们和币安中国、火币中国等头部企业实现了集团层面的战略合作,将共同探索如何在合规框架下,将地产基金、企业债等实体资产结合区块链技术,提供给用户有价值的产品。 3)技术基础设施,如前所述,在定价、预言机、智能合约、清算机制、治理结构和风控等诸多方面,实体资产需要定制化的解决方案。我们技术团队正在针对实体资产的价格抓取、预言机开发、支持跨链的协议等诸多方面进行研发,市场和金融团队也在与UBS、房地美、黑石等在内的传统金融机构和国际知名律所如OMM、Baker McKenzie、达辉等深度沟通,探索包括贷款分层、信托结构等一系列解决方案。 UPRETS, as a financial technology company backed by the New York Stock Exchange-listed real estate company Xinyuan Group (NYSE: XIN), is born with the dual genes of real estate and technology. It not only has more than 20 years’ experience with industrial resources in the real estate industry, but also has more than 5 years of development, exploration and application of blockchain technology development and industrial applications. We have always believed that digital transformation is an inevitable trend for the real estate industry. Data will become a more precious and valuable asset than the real thing. If the blockchain industry wants to develop in the long term, it must also be integrated with the real economy. We want to act as a bridge to digitize physical assets and enter the DeFi ecosystem. Currently, UPRETS’ product line includes three main aspects: digital securities issuance, DeFi mortgage and lending, and technical infrastructure. 1) In terms of digital securities, UPRETS successfully issued the world's first real estate digital securities listed for trading on the secondary market. In March 2020, it completed the primary market fundraising (RegS) of the Oosten project in East River Bay, New York, in 2020. In June, we completed the technical issuance of digital securities (OST, applicable to mainstream protocols such as Xbolt consortium chain, Ethereum and Bitcoin Omni), and registered and traded them in the secondary market-Seychelles's licensed securities exchange MERJ. At the same time, we will continue to serve Xinyuan International’s own real estate projects worth hundreds of millions of dollars, and externally cooperate on projects worth billions of dollars, providing full-process guidance from consulting, architecture design, technology issuance to secondary transactions; 2) DeFi mortgage and lending. UPRETS is working closely with the leading DeFi projects on the mainstream public chain to contribute more high-quality digital securities based on physical assets to the DeFi mortgage pool. 1. We work closely with the MakerDAO community, the largest stablecoin ecosystem on Ethereum, and became a founding member of the RWA (real world assets) working group. We cooperate with German companies such as Centrifuge and the US real estate fund Resolute.fund, and plan to include priority loans in the DAI mortgage pool. In June 2021, DAI will have applied for hundreds of millions of dollars of credit line for the physical industry. 2. We are also working closely with more public chain ecosystems, such as Binance Smart Chain, Ontology, NEO, Polkadot,etc. In 2019, we achieved group-level strategic cooperation with leading companies such as Binance China and Huobi China. We will jointly explore how to combine physical assets such as real estate funds and corporate bonds with blockchain technology under a compliance framework to provide users with valuable products. 3) Technical infrastructure: as mentioned above, physical assets require customized solutions in terms of pricing, oracles, smart contracts, clearing mechanisms, governance structures, and risk control. Our technical team is conducting research and development in many aspects such as price capture of physical assets, oracle development, and support for cross-chain agreements. The market and financial teams are also working with traditional financial institutions and international organizations such as UBS, Freddie Mac, Blackstone, etc. and well-known law firms such as OMM, Baker McKenzie, Dahui, etc., having had in-depth communication and explored a series of solutions including loan stratification and trust structure. 6、如何进行房地产资产通证? 6.?How to tokenize real estate assets?(only ENG version) 魏然魏总: OST is asset-based digital securities based on advanced digitalization technology designed for global real estate investors and blockchain enthusiasts. With offices in New York, Dubai and Beijing, entwined with its extensive range of strategic partnerships, the international digitalization platform UPRETS aids in developing the non-fungible tokens to create a legally compliant real estate financial product available for investors with revolutionary spirits. Secondary trading on MERJ Exchange further facilitates KYC/AML, market assurance and trading liquidity. For more information, go to?https://www.uprets.io/#/events/merj?2. OST是为全球房地产投资者和区块链爱好者设计基于先进数字化技术的资产型数字证券公司,它在纽约、迪拜和北京设有办事处,拥有广泛的战略合作伙伴关系,国际数字化平台UPRETS帮助其开发不可替代的代币,从而为具有革命精神的投资者创造合法合规的房地产金融产品。MERJ交易所的二级交易进一步促进了KYC/AML、市场保障和交易流动性。更多信息请访问https://www.uprets.io/#/events/merj 2。

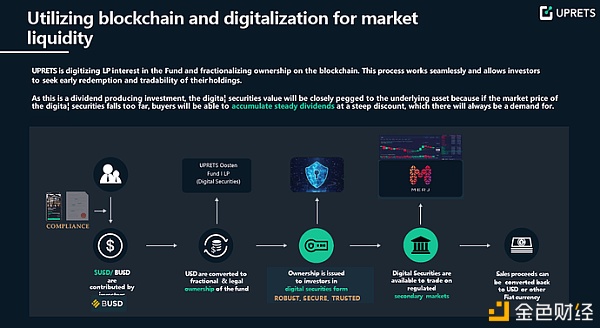

The Omnilayer & self-owned patented consortium chain Xbolt secures the OST digital securities structure and its compatibility to mainstream public chain and secondary exchanges and enables support payment with FIAT and BUSD. The ownership is issued to investors in a robust, secure and trusted digital securities form to accumulate steady dividends at a steep discount, which there will always be a demand for global real estate investors. Omnilayer &自有专利财团chain Xbolt确保了OST数字证券结构及其与主流公链和二级交易所的兼容性,并支持FIAT和BUSD支付。所有权以稳健、安全、可信的数字证券形式发行给投资者,以大幅折价积累稳定的股息,这对满足全球房地产投资者的需求提供了帮助。

OST is the phase I legally compliant digital securities of the Oosten project, corresponding to the limited partnership interest of UPRETS Oosten Fund I LP, a real estate fund company located in Delaware, USA that holds the apartment No.730. UPRETS Oosten Fund I LP was completed through private equity investment on March 13, 2020, in compliance with the U.S. SEC’s Reg D and S standards, and simultaneously issued 100 million corresponding OST digital securities through the digitalization technology platform, UPRETS, and was listed on the MERJ Exchange on June 5, 2020, and opened the first transaction on June 25, 2020. OST是Oosten项目第一期合法合规的数字证券,对应UPRETS Oosten Fund I LP的有限合伙权益。UPRETS Oosten Fund I LP是一家位于美国特拉华州的房地产基金公司,持有编号为730的公寓。UPRETS Oosten基金LP是通过私人股本投资2020年于3月13日完成,符合美国证券交易委员会注册D和S标准,同时通过数字化技术平台发出了1亿张对应的OST数字证券,并于2020你去哪6月5日在MERJ交易所上市,2020年6月25日开始第一笔交易。

7、UPRETS是房地产资产通证化平台目前有什么落地应用生态吗?(only ENG version) 7. Uprets is a real estate trading?platform. Is there any application ecology at present??(only ENG version) 魏然魏总: UPRETS (uprets.io) aims to provide one-stop real estate digital securities issuance, secondary exchange listing and fundraising?structure?assistance to energize global Real Estate?investment among all parties (developers, asset originators & investors). UPRETS (UPRETS .io)旨在提供一站式的房地产数字证券发行、二级交易所上市和融资结构协助,以激发各方(开发商、资产发起人和投资者)的全球房地产投资。 In 2020, UPRETS successfully issued $1m worth of OST for the Oosten Properties in NYC.?OST is the phase I legally compliant digital securities of the Oosten project, corresponding to the limited partnership interest of UPRETS Oosten Fund I LP(https://sec.report/CIK/0001795065), a real estate fund company located in Delaware, USA that holds Oosten apartment No.730. 2020年,UPRETS成功发行了价值100万美元的OST,用于纽约的Oosten Properties。OST是Oosten项目第一期合法合规的数字证券,对应于UPRETS Oosten Fund I LP(https://sec.report/CIK/0001795065)的有限合伙权益。UPRETS Oosten Fund I LP是一家位于美国特拉华州的房地产基金公司,持有Oosten公寓No.730。 UPRETS Oosten Fund I LP was completed through private equity investment on March 13, 2020, in compliance with the U.S. SEC’s Reg D and S standards, and simultaneously issued 100 million corresponding OST digital securities through the digitalization technology platform, UPRETS. It was then listed on the MERJ Exchange(https://merj.exchange/) on June 5, 2020, and opened the first transaction on June 25, 2020. UPRETS Oosten Fund I LP于2020年3月13日通过私募股权投资完成,符合美国SEC的Reg D和S标准,并通过数字化技术平台UPRETS同时发行1亿相应的OST数字证券。随后,该公司于2020年6月5日在MERJ交易所(https://merj.exchange/)上市,并于2020年6月25日启动了首笔交易。 UPRETS’ growth plan consists of digitalizing and securitizing new RE assets and bonds (including Loans, REITS and CMBS), attracting more investors to the world of ST, through the establishment of partnerships to jointly help the industry mature and develop the standards of the future digital investment ecosystem. With the active involvement of exchanges such as Fusang Exchange, MERJ, HKbitEX and Investment Banks like UBS, we can play a meaningful role in modernizing the securities space. UPRETS的增长计划包括将新的RE资产和债券(包括贷款、REITS和CMBS)数字化和证券化,通过建立合作伙伴关系,共同帮助行业走向成熟并制定未来数字投资生态系统标准,吸引更多的投资者进入ST的世界。有了Fusang Exchange、MERJ、HKbitEX和瑞银等投资银行的积极参与,我们可以在证券市场现代化方面发挥重要作用。 In regards to corporate bonds, we intend to strengthen their wide-coverage on secondary venues?in order?to arm them with additional liquidity and to lower the entry barrier. XIN International,?in collaboration?with its strategic partner Fusang Group, provides legally compliant digital corporate bond products available on Fusang exchange for individual investors to join. 就公司债券而言,我们打算加强其在二级市场的广泛覆盖,以增加它们的流动性,并降低进入门槛。XIN国际与其战略合作伙伴Fusang集团(Fusang Group)合作,在Fusang交易所(Fusang exchange)提供符合法律规定的数字公司债券产品,供个人投资者认购。 FAN(www.fan.finance) is the portal which facilitates onboarding of Real World Assets (RWA) onchain globally. FAN platform aims to act as the supplier of RWA for mainstream stable coin’s collateral pool such as MakerDAO’s CDP(makerdao.com). In the long run, FAN stable coins will be issued based on this collateral, and is generated by a?FAN Smart Contract through over-collateralizing real estate digital securities (e.g. OST) on our FAN website (5).?The?stable value?of the FAN/USDT exchange pair at 1?can be realized through a Smart Contract algorithm and through the holders' consensus?and wide-use of FAN. The amount of FAN created is determined by the?value of collaterals?and the appropriate?asset LTV (loan-to-value) ratio, as?voted by FAN community members. FAN(www.fan.finance)门户网站,在全球范围内促进真实世界资产(RWA)的上线。FAN平台的目标是作为主流稳定币抵押池的RWA供应商,如MakerDAO的CDP(makerdao.com)。从长远来看将根据此抵押品发行FAN稳定币,并由FAN智能合约通过在FAN网站上对房地产数字证券(例如OST)进行超额抵押来生成(5)。可以通过智能合约算法以及持有人的共识和对FAN的广泛使用来实现FAN/USDT交易对的稳定价值1,创建的FAN的数量取决于抵押品的价值和适当的资产LTV(贷款对价值)比率,由FAN社区成员投票决定。 The objective?is to establish the vertical niche of real estate digital securities-backed MakerDAO.?UPRETS will continue to explore the Fintech industry to support capital Raising Opportunities. 我们的目标是建立房地产数字证券支持的MakerDAO的垂直利基。UPRETS将继续探索金融科技行业,以支持融资机会。 8、我们知道区块链是一个新兴的行业,目前很多国家的政策都持观望态度,这对UPRETS开拓全球版图有何影响吗? 8.?We know that blockchain is an emerging industry. At present, the policies of many countries hold a wait-and-see attitude. Does this have any impact on the global expansion of uprets? 魏然魏总: UPRETS是依托我们集团公司鑫苑国际的地产项目开展科技化业务的,我们在美国纽约、英国伦敦、马来西亚都有地产项目。比如纽约东河湾项目的资产和基金结构是在美国境内的,但数字证券登陆的是离岸金融中心塞舌尔的交易所。我认为核心的标杆资产还是在欧美地区较多,但交易的场所会在金融中心比如新加坡、香港、塞舌尔、马来纳闽特区等。 与传统资本市场略有不同的是,区块链生来就是国际化的产业,面向的是全球的资本市场和数以万计的交易所,各国政府互相博弈,各有所图,对区块链抱持着不同的态度,故而无法形成合谋,这就使得跨境的政策套利成为可能。项目可以从政策友好的国家如新加坡取得法律和合规文件,从注册在瑞士和开曼的风险基金处获得融资,再到注册于马耳他的交易所上市。针对这种全球政策套利的现象,美国的著名风险投资人Tim Draper说,比特币对他来说最激动人心的一点便是它是一个全球货币,由此,未来各国政府会变成一个个需要进行公开竞争的公共政务提供商,而不再是特定国境内的垄断者。Virtual Citizens(数字公民)和创业者可以用脚投票,我不喜欢你便可以离开,转向其他地域更友好的政务服务商。因为行业的这种特性,各国尤其是小国,会有一种FOMO(Fear of missing out,错失机会恐惧症)和想要借此弯道超车的心态,故而选择对区块链态度友好。 9、圣穆德资本和UPRETS房地产资产通证化平台会进行合作吗?如果是的话,将会如何合作? 9. Will Sanctum?capital and uprets have the opportunity to become partners? If so, how will they cooperate? Yes, we’re willing to work with Sanctum capital. In terms of market education, collaboration of DeFi protocols, etc. 感谢魏然魏总、RICO 彭岦囯的分享,也谢谢大家的热情,今天圣穆德的社区AMA 到此结束。 —- 编译者/作者:Cat说区块链 玩币族申明:玩币族作为开放的资讯翻译/分享平台,所提供的所有资讯仅代表作者个人观点,与玩币族平台立场无关,且不构成任何投资理财建议。文章版权归原作者所有。 |

圣穆德社区AMA第1期

2021-02-04 Cat说区块链 来源:区块链网络

LOADING...

相关阅读:

- 完美切换主流!以太坊突破前高开启剑指1万美金之路!2月4日老俞区块链2021-02-04

- FilecoinPlus分析讲解2021-02-04

- Ceramic管理系统使用IPFS技术运行2021-02-04

- 区块链交易新战场、区域开拓新典型2021-02-04

- 比养孩子大1000倍的金融大瓜:蚂蚁吞大象?如何用期权拉爆百亿美元对2021-02-04