宏观新闻 MakerDAO的大部分资产价值都集中在几个地址中

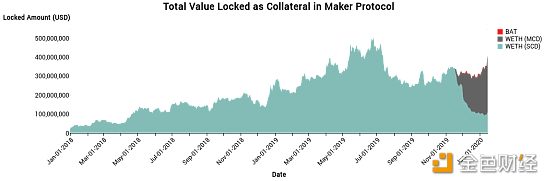

根据Digital Assets Data的数据,截至1月17日,价值约4亿美元的抵押品资产被锁定在MakerDAO协议稳定性系统中。与此同时,Dai系统锁定的以太坊数量达到近250万的历史最高水平,约占以太坊总供应量的2.2%。此外,锁定在DeFI中的DAI价值最近增加到了5000万美元,同比增长了65%。尽管DeFi市场在过去的12个月里呈爆炸式增长,但活动仅在一小部分地址中发生。在旧的Maker协议上,“单抵押品Sai”上创建了大约155,000个CDP。然而,截至1月15日,77%持有不到0.05 ETH(截至发稿时为8.10美元)。此外,只有一个帐户持有171,000 PETH,占PETH总量的27%。同样,大多数帐户的规模很小,但是这些地址仅占锁定总WETH的4%。同时,有一个地址持有锁定值的15%,另一个地址持有将近8%。这两个账户持有近四分之一的抵押品。 DeFi is the movement to transform old financial products into trustless and transparent protocols that run on decentralized applications built using smart contract platforms like ethereum. The most popular DeFi protocol right now is MakerDAO's multi-collateral Dai system, where users create “collateralized debt positions” (CDP) by putting up ether or other ERC-20 tokens as collateral to generate DAI tokens up to two-thirds of the value of the ether. The generated DAI serves as a debt and can be used in the same manner as any other cryptocurrency; it can be freely sent to others, used as payments for goods and services, or held as long-term savings. Since DAI's value is pegged to the U.S. dollar, a user only owes back what he or she initially borrowed with interest. As of Jan. 17, about $400 million worth of assets used as collateral were locked up in MakerDAO protocol Stability system, according to Digital Assets Data. ◎内容来源:?https://www.livebitcoinnews.com/australia-has-a-plan-for-monitoring-libra/ Zcash社区投票决定分配20%的挖矿奖励以支持开发

Zcash社区已投票支持分配网络挖矿奖励的新方法,以支持Zcash开发。根据投票决定,从1,046,400区块开始,Zcash挖矿奖励的20%将分配给开发基金,而矿工将获得80%。开发资金将在不同各方间分配。Electric Coin Company将获得7%的挖矿奖励,Zcash基金会将获得5%,其余8%将用于向第三方开发商提供赠款。如果Zcash基金会和Electric Coin Company同意继续推行,这一新的奖励结构将于2020年11月实施。 The Zcash community has voted on a new methodology for distributing network mining rewards to support the development of the privacy-oriented cryptocurrency. Per the?voting decision, 20% of the Zcash mining rewards will be?allocated?to a development fund, while miners will get 80% as of block 1,046,400. The development funds will be distributed among different parties. Electric Coin Company will get 7% of mining rewards, the Zcash Foundation will get 5% and the rest 8% will be used for grants to third-party developers. The new rewarding structure would get implemented in November 2020 if the Zcash Foundation and Electric Coin Company – the main firm behind Zcash’s development – agree to go ahead with it. ◎内容来源:?https://www.livebitcoinnews.com/australia-has-a-plan-for-monitoring-libra/ 企业发展 Coinbase聘请谷歌前产品副总裁担任首席产品官

Coinbase已聘请谷歌前产品副总裁Surojit Chatterjee担任其首席产品官。Chatterjee在谷歌工作了11年,在谷歌从事支付、广告技术和商务工作。在此之前,他是印度电子商务网站Flipkart的产品负责人。 Surojit Chatterjee spent 11 years at Google, where he worked on payments, adtech and commerce. He most recently led the continuing development of Google Shopping, a service available in more than 90 countries. Prior to that, he was the head of product at Indian e-commerce site Flipkart. Chatterjee is Coinbase’s first chief product officer since the?departure?of Jeremy Henrickson in December 2018, the company confirmed. In his new role Chatterjee will focus on “making the cryptoeconomy accessible to millions more people through Coinbase’s suite of products,” CEO Brian Armstrong said in a statement. Last November, the exchange?added?support for five new crypto options to its Visa debit card and began allowing users to?earn?rewards on their cryptocurrency holdings, starting with the Tezos token. For his part, Chatterjee became passionate about separating money from the state after growing up in India under government-run banks and seeing the Indian government switch over to new currencies in November 2016, requiring the entire population to either use a bank or a post office to convert their cash. Currently, the Indian government has?blocked?banks from dealing with the crypto industry but hasn’t outlawed the use of cryptocurrencies themselves. ◎内容来源:https://www.theblockcrypto.com/linked/46594/bitfinex-to-launch-options-and-gold-backed-stablecoin 专业分析 彭博:火币2019年营收约6.8亿美金,政府关系领先竞争对手

据彭博社披露,交易所业务占火币总收入的80%以上,来自中国的用户仍然是最大的用户来源,预估火币2019年收入约为6.8亿美元。火币总数1300名员工中,一半从事交易所相关业务。还指出,在与北京的政府关系上,火币领先于币安等竞争对手,火币参与创立中国第一个国家支持的区块链平台。区块链咨询公司Matthew Graham表示,火币的风险是,与北京的亲密关系可能会导致其失去海外客户的信任。 Leon Li is the rarest of Chinese crypto magnates -- one who’s won Beijing’s backing. The founder of Huobi Group is now set to play a pivotal role in China’s effort to build a homegrown crypto-industry. The former?Oracle Corp.?coder, who started one of the world’s largest Bitcoin exchanges six years ago, enjoys unusual access to China’s central bank and government officials thanks to methodical engagement and measured expansion. While rivals?Binance?and OKEx irked regulators by stoking Bitcoin mania, Li curried favor by discouraging speculation, co-founding the country’s first state-backed blockchain platform along the way. Huobi even set up a Communist Party committee in-house -- a first for any crypto firm. That’s why, keen to explore homegrown alternatives to?Facebook Inc.’s Libra and a Western-led blockchain, Chinese central bank and government officials are turning to Li -- among others -- to help develop a local blueprint for crypto supremacy. The still-nascent blockchain arena offers the world’s second-largest economy a rare chance to become an early influencer. Washington’s concerted campaign to contain China has only strengthened Beijing’s resolve to wean itself off American technology. ◎内容来源:https://twitter.com/Rhythmtrader/status/1187822745935060992 大咖链语 Fundstrat联合创始人:比特币已重新回到牛市趋势

Fundstrat联合创始人Tom Lee表示,比特币已突破200天移动平均线(DMA),这意味着比特币已重新回到牛市趋势。 200 DMA is a widely tracked moving average that gives investors a much-appreciated clue about the dominant long-term trend of a certain asset. Given that this indicator is used by a plethora of traders, it essentially becomes a self-fulfilling prophecy. It generally considered that the asset remains in a bearish trend as long as it stays below?the 200 DMA line. As soon as its price closes above this line, it's time for the bulls to take back control over the market. Lee points to the fact that Bitcoin's win-rate tends to jump to 80 percent above when it is trading above its 200 DMA. Bitcoin has already gained?26.5 percent this year, which is its strongest January since 2012. It has so far trumped gold, the S&P 500, and other traditional assets. However, the top cryptocurrency is not going to stop there. As U.Today reported,?Fundstrat predicted?that BTC could gain more than 100 percent this year on the halvening narrative and global uncertainty. ◎内容来源:https://www.cnbc.com/2019/10/22/facebook-ceo-mark-zuckerbergs-prepared-remarks-before-congress.html 比特币早期投资者:如果社区不做出重大改变,比特币将成为下一个MySpace

早期的比特币投资者Erik Finman表示,自2011年以来,比特币周围的环境发生了显着变化,并没有变得更好。比特币已不再是过去的样子。Finman称,比特币“团结”和“尖端”技术的时代似乎已经过去。我真的很在乎比特币,但我认为社区似乎无法将其整合在一起。我试图让社区参与修复它,但其非常敌对。社区中仍然有很多很棒的人,还有在技术问题上非常聪明的人。然而,即使世界动荡不安,比特币也不一定是人们在这样的时候投入资金的加密货币。他指出,Monero和Zcash是潜在的更好选择。Finman补充说,如果社区无法做出重大改变,比特币将成为下一个MySpace。 A millionaire by age 18, early Bitcoin (BTC) investor Erik Finman said the environment around Bitcoin has significantly changed since 2011 — and not for the better. “It just ain’t what it used to be,” Finman told Cointelegraph in a message on Jan. 26, 2020. Recounting the early days, Finman explained: “Bitcoin, when it first came out, was incredible. It wasn’t just cutting edge technology - it was bleeding edge! You just felt the energy in the air. That this was the real deal. Everyone felt united in this cause — this mission. Those were some of the most beautiful moments of my life.” Investing in 2011 Finman made headlines over the past several years for his success as a young Bitcoiner. Finman invested $1,000 into BTC in 2011, turning him into a millionaire by the age of 18 due to Bitcoin’s dramatic price increases, Cointelegraph?detailed?in June 2017. In late 2018, however, Finman?expressed?his thoughts on Bitcoin’s eventual demise based on several factors, including community infighting, etc. ◎内容来源:https://twitter.com/jchervinsky/status/1194340207128170496 Coinbase首席执行官:美国国债激增将对金融系统造成重大打击,使加密货币比美元更加稳健

美国国会预算办公室最近报告称,美国联邦政府债务将在10年内激增。对此,Coinbase首席执行官Brian Armstrong表示,随着美国国债在未来十年内飙升至31.4万亿美元,政府货币有望被视为“有趣的钱”。国债激增将对金融系统造成重大打击,使加密货币比美元更加稳健。Armstrong认为,随着人们开始意识到美元会如何贬值,对加密货币的看法发生根本性转变只是时间问题。 Coinbase CEO Brian Armstrong says government currency is on track to be regarded as “funny money” as the US national debt roars toward $31.4 trillion over the next decade. Citing a new study published on Tuesday by the Congressional Budget Office (CBO), Armstrong, who runs the largest Bitcoin (BTC) exchange in the US, tweeted “consider crypto” to his 318,000 followers. The CBO report says the US federal government debt will surge within 10 years. Armstrong believes it will be a big blow to the financial system, establishing cryptocurrency as more sound and stable than the US dollar. Says?Armstrong, “And crypto is seen as real money that people can’t tamper with (at least control is decentralized and I can trust people to review the open source code). Why put your livelihood into something that could be manipulated or devalued without your input.” The?CBO projection?is staggering: the projected $31.4 trillion debt is the highest level since the end of World War II, equal to 98% of gross domestic product. ◎内容来源:https://cryptonews.com/news/former-brazilian-central-bank-chief-praises-bitcoin-libra-4342.htm 法律监管 Andreas Antonopoulos支持Liebowitz的法律团队领导针对Bitfinex等的集体诉讼

比特币安全专家Andreas Antonopoulos于1月27日提交宣誓书,支持Liebowitz的法律团队领导针对Bitfinex及其附属公司的集体诉讼。Antonopoulos想通过他所看到的的该团队在Kleiman与澳本聪一案中的表现证明其专业知识。据悉,近几个月来,Bitfinex、Tether和iFinex被提起了四项集体诉讼。本周初,首席法官下令将这四个案件合并。但是,由谁来领导该诉讼的问题仍然存在。 One of the biggest names in crypto has joined in an ongoing argument about who will lead the class-action suit against Bitfinex and its affiliates over alleged market manipulation leading to Bitcoin’s 2017 bull run. Antonopoulos’s affidavit Amid a flurry of filings seeking to lead the class, Andreas Antonopoulos has come out in support of the legal team of Liebowitz, filing an?affidavit?on Jan. 27 vouching for the expertise of the team — which Antonopoulos has seen in action on the Kleiman v. Wright?case. Liebowitz’s representation includes a laundry list of attorneys from three separate firms, but Antonopoulos specifically commended Kyle Roche of Roche Cyrulnik Freedman as the reason the firm should lead the proceedings. Before calling the firm “uniquely qualified to represent members of the class,” Antonopoulos wrote: “In the Kleiman matter, Mr. Roche has repeatedly demonstrated an understanding of the technical and functional properties of bitcoin, cryptocurrencies, blockchain, and their underlying cryptographic principles superior to many other attorneys.” ◎内容来源:https://finance.yahoo.com/news/virus-emerges-shadowy-north-korean-150021290.html —- 编译者/作者:区块列车邮件 玩币族申明:玩币族作为开放的资讯翻译/分享平台,所提供的所有资讯仅代表作者个人观点,与玩币族平台立场无关,且不构成任何投资理财建议。文章版权归原作者所有。 |

重回牛市?小心这些危险信号

2020-01-30 区块列车邮件 来源:区块链网络

LOADING...

相关阅读:

- 币圈鸿钧:10.31比特币以太坊波动区间扩大昨日又双双叒叕止盈出局2020-10-31

- 杨凯:月线收官之战比特币多空难以突围2020-10-31

- 比特币策略完美到达200多点丽润2020-10-31

- 诗萱言币10.31比特币以太坊的技术指标中均线修复的表现形式有哪些2020-10-31

- 币圈玩家再次体会到坐过山车的感觉2020-10-31