2021 年 6 月 9日,Sunder?finance的创始人Magnum来大橙子社区聊聊如何将治理代币的效用最大化?Sunder 首创的“拆分”模型,将治理代币拆分为“纯治理”和”纯收益“代币,让治理币的持有者可以最大化的提取价值! 嘉宾:Magnum | Sunder Protocol ?Long| Sunder Protocol 主持人: 娜塔莎|响指研究所 以下是本次 AMA 的文字整理。 推特:https://twitter.com/SunderFinance 介绍:https://sunderfinance.medium.com/presenting-sunder-protocol-x-sushi-integration-1a86b639e976 Dutch Auction: 6/7 20:00 https://miso.sushi.com/auctions/0xEd4A285845f19945b0EbC04a3165e3DCAf62fEeD One paragraph intro: At Sunder, we’re thrilled to present our first step towards fixing one of the few dilemmas left unsolved in DeFi. Governance participation and Interest bearing products should not be mutually exclusive. Sunder Protocol enabled a solution under which participants can enjoy both DAO participation and earning yield on governance tokens in an efficient manner, as well as new forms of pricing/speculation over the above-mentioned isolated utilities. Hello, 大家好,我是今天的主持人~ 先给大家简单介绍下项目 Sunder 协议旨在解决Defi治理类代币不能同时参与治理以及享有收益的难题。通过系统性的设计,把治理类代币的治理功能和收益功能进行拆分,并首创了纯治理代币以及纯收益代币的自由市场,实现了无需gas的投票,自动收益,重新定义了治理类代币DAO以及未来收益的价值。 AMA question list: Hello, Magnum and Long could you please introduce yourself? Please give a brief introduction about what Sunder Protocol is? 哈咯,Magnum 和 Long 可以向大家简单介绍下你们自己和 Sunder 协议吗? Long: Hi this is Long, co-creator of Sunder Protocol I have a finance and engineering background and have been full time in crypto for 4 years and BUIDL since the beginning. Long:大家好,我是 Long,Sunder Protocol 的联合创始人,我有金融和工程背景,全职从事加密货币行业 4 年了,入行开始就在进行开发。 Magnum: Pleasure to be attending this AMA. I'm Magnum, co-creator of Sunder Protocol, and early adopter/contributor to the DeFi movement since 2016. As for our other core team members, we’re mostly a diverse team of engineers and crypto native economists including core contributors to YearnFinance and Filecoin. You can track our experience and contributions on our Github: https://medium.com/r?url=https%3A%2F%2Fgithub.com%2FSunderfinance%2Fsunder-contractsSunder Protocol is the first framework that allows for utilities of Governance tokens to be mutually inclusive, enabling participants to remain exposed while being able to bear interest via strategies, without sacrificing on voting rights. By exclusively integrating with Sushi Protocol, we’ve enabled a solution under which participants can enjoy both DAO participation and earning yield on governance tokens in an efficient manner, as well as new forms of pricing/speculation over the above-mentioned isolated utilities. Magnum: 很高兴能参加这次 AMA。我是 Magnum,Sunder Protocol 的联合构建者,自 2016年以来一直是 DeFi 活动的早期采用者/贡献者。 至于我们的其他核心团队成员,我们主要是一个由工程师和加密货币原生经济学家组成的多元化团队,包括 YearnFinance 和 Filecoin 的核心贡献者。你可以在我们的 Github 上浏览我们的经验和贡献:https://medium.com/r?url=https%3A%2F%2Fgithub.com%2FSunderfinance%2Fsunder-contracts Sunder 协议是第一个允许治理代币的功能相互包容的框架,使参与者能拥有治理权,同时能够通过策略获得利息,而不需牺牲投票权。通过与 Sushi Protocol 的独家整合,我们实现了一个解决方案,在这个方案下,参与者可以同时享受 DAO 的参与和以有效的方式赚取治理代币的收益,以及对上述独立的功能(纯治理/纯收益代币)进行新形式的定价/投机等一系列操作。 We know that Sunder Protocol allow to split the original governance token into 2 tokens- Dtoken and Etoken, and allowed them to have their own prices and even can do LP miming. What are the benefits to attract users doing this “Sunder” there governance token? 我了解到 Sunder 协议允许将治理代币拆分为纯收益代币+纯治理代币,甚至允许它们有各自独立的价格,也可以参与流动性挖矿。请问吸引用户将他们的治理代币「拆分」的点在哪里? A: What is the essential difference between Sunder Protocol and Snapshot, because we know that Snapchat is the biggest governance platform now, what is the advantage of your solution? Sunder Protocol 和 Snapshot 的本质区别是什么,因为我们知道 Snapchat 是现在最大的治理平台,你们解决方案的优势是什么? Great question. The key difference is whether the execution of governance proposals is 100% onchain or not. Snapshot is a tool that takes a snapshot of balances of addresses and records results accordingly. The real execution normally requires a multisig address or admin account. Sunder Protocol works with protocols like Compound and Uniswap that has full onchain governance module which the upgrade requires onchain voting and does not rely on a few accounts. Moreover if protocols can choose to adapt to Dtoken voting results, that would be easier for all so investors can enjoy Dtoken voting for free while earning from staking Etokens. 这是个好问题,关键的区别在于治理建议的执行是否 100% 在链上。Snapshot 是一种工具,对地址的余额进行快照,并相应记录结果。真正的执行通常需要一个多签地址或管理者账户(这样本质上还是中心化的)。Sunder 协议与 Compound 和 Uniswap 等协议合作,这些协议有完整的链上治理模块,其升级(或是更新)需要链上投票,而不是依赖少数账户。此外,如果协议可以选择适应 Dtoken(纯治理权代币)的投票结果,那对所有人来说都会更容易,所以投资者可以免费享受 Dtoken 的投票,同时从押注 Etokens (纯收益权代币)中获得收益。 What is the use case of the DAO and Earning Isolated Token, and how do you make sure the sum of those two tokens are always equal to the original governance token? 你们如何保证 DAO 纯治理权代币(Dtoken)和 Earning 纯收益权代币(Etoken),这两者相加永远都能够换回原本拆分前的治理代币呢? The issuance of DAO and Earnings Token are strictly 1:1, and both issuance and redemption are open at all times. In order to redeem underlying governance tokens back, users will need to own both DAO- and Earnings Isolated tokens at a 1:1 ratio in order to receive the designated amount of underlying tokens back. This is set in stone at a protocol level, coded into core contracts, and cannot be circumvented. DAO 和 Earnings 代币的发行严格按照1:1进行,发行和赎回都是随时开放的。 为了赎回基础治理代币,用户需要以 1:1 的比例同时拥有 DAO 和 Earnings 这两个独立的代币,以获得指定数量的原代币。 这是在协议层面上设定的,编写在核心智能合约,无法违反。 What is the voting power of the DAO Isolated Token from the original token, will it’s effectiveness be weakened? Will users get some benefit from using DAO isolated tokens to participate in governance? DAO 纯治理代币与原始代币的投票权一样吗? 它的效力是否会被削弱?用户使用 DAO 纯治理代币参与治理,会得到其他好处吗? A: As the DAO Isolated Tokens are collateralized at a 1:1 ratio with its underlying Governance Token, the voting power corresponds to and remains the same, without being weakened. Some of the advantages of DAO Isolated tokens compared to on-chain voting modules:Users can directly vote without need of transaction fees for on-chain voting, as Sunder collects voting intention via Snapshot, and takes direct care over wallet management for executing votes from the Sunder Vaults. In addition, users can utilise DAO Isolated tokens for earning Yields in SUNDER in exchange for being deployed for liquidity provision on Sushiswap AMM Pools. 由于 DAO 纯治理代币与它的基础治理代币以 1:1 的比例进行抵押,投票权对应并保持不变,不会被削弱。 与链上投票模块相比,DAO 纯治理代币的一些优势: 用户可以直接投票,不需要链上投票的 Gas 费用,因为 Sunder 通过 Snapshot 收集投票意向,并直接映射到用户的钱包,并从 Sunder Vaults 执行投票。 此外,用户可以利用 DAO 纯治理代币在 SUNDER 中赚取收益,以换取被部署在 Sushiswap AMM 池中的流动性供应。 Can you introduce Sunder Protocol’s token metric and token distribution? 可以向大家介绍下 Sunder 协议的代币经济模型和分配吗?

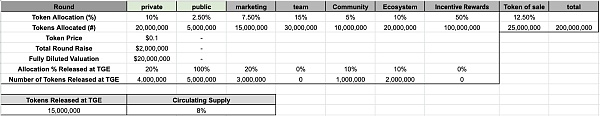

Ticker: SUNDER Blockchain Network: Ethereum, ERC-20 Minted Supply: 100,000,000 SUNDERMiso IDO:https://miso.sushi.com/auctions/0xEd4A285845f19945b0EbC04a3165e3DCAf62fEeDStart:June 7th, 2021, 12:00pm UTC End:June 10th, 2021, 12:00pm UTC Type:Dutch Auction Price per token:$3 to $0,2, linear decay until target reached Raised Currency:USDC Total number of tokens to be sold: 5,000,000 SUNDER Please note:The Sunder IDO will be on a First Come First Serve basis and we will be using the Dutch Auction Type provided by Miso Factory.Private Sale Raised: $2,000,000 Price: $0,1 Lock-up: 20% at the TGE; 20% on a quarterly basis for 12 months 代币代号: SUNDER 区块链网络:以太坊,ERC-20 总供应:100,000,000 SUNDER Sushi MISO IDO 池子:https://miso.sushi.com/auctions/0xEd4A285845f19945b0EbC04a3165e3DCAf62fEeD IDO时间:2021/6/7 20:00~ 2021/6/10 20:00 结束(北京时间)类型:荷兰式拍卖 每个代币的价格:3 美元到 0.2 美元,线性衰减直到达到目标 升值货币:USDC IDO 代币总数:5,000,000 SUNDER 请注意:Sunder IDO 将采用先到先得的原则,我们将使用 MISO Factory 提供的荷兰式拍卖。 私募轮信息: 募集资金:2,000,000 美元 价格:0.1 美元 锁定:TGE 20%; 12 个月内每季度 20% For those Sunder Governance Token ($SUNDER) ?holders, what are the benefits will they get? ?Also, how can they contribute to the Sunder Protocol? 对于 Sunder 治理代币($SUNDER)的持有者,他们会得到什么好处? 另外,他们如何为 Sunder 协议作出贡献? A: SUNDER is the Core Governance Token for the Sunder Protocol. as stated below, users can interact/contribute in various levels with SUNDER: - Governance Participation & Proposals - Participation on Earnings, Vault & Strategies (incentivised with protocol fees for Strategists) - Participation on Integration with additional Governance Modules (propose & vote, decide on allocation for mining rewards) - Single-sided Staking for cash-flow distribution (protocol fees) - Incentivised liquidity provision on Sushi AMM Pools 答:SUNDER 是 Sunder 协议的核心治理代币。如下所述,用户可以与 SUNDER 进行不同程度的互动/贡献。 - 参与治理和提议。 - 参与收益、金库和战略的制定。 - 参与与其他治理模块的整合(提议和投票,决定挖矿奖励的分配)。 - 现金流分配的单币质押。 - 寿司 AMM 池的激励性流动性挖矿。 Can you introduce your investors and partners? What type of projects can Sunder Protocol cooperate with? 您能介绍一下您的投资者和合作伙伴吗? Sunder Protocol 可以合作哪些类型的项目? A:We choose not to disclose our investors for the time being. As for partners any projects with Compound governance modules or similar governance models can be smoothly sundered. As for projects or protocols with the snapshot + multisig model if they can recognize dtoken snapshot results . Again these projects can be categorized into on-chain governance and of-chain governance types. On chain voting refers to governance systems where individual votes are submitted as transactions, and recorded directly on the blockchain. Submitting on chain requires users to pay a transaction fee for each vote. Off chain voting refers to governance systems where individual votes are not submitted as blockchain transactions. No transaction fees are necessary for off chain votes. From Sunder’s perspective we are the bridge between onchain voting and off chain voting and also we defined the value of voting, bringing more participation to onchain voting and also rewarding participation. 答:我们暂时不披露我们的投资者。对于合作伙伴,任何具有复合治理模块或类似治理模型的项目都可以顺利通过 Sunder 协议拆分他们的治理代币。至于 snapshot+multisig 模型的项目或协议,如果能识别 dtoken 的 snapshot 结果。同样,这些项目可以分为链上治理和链下治理类型。 链上投票是指将个人投票作为交易提交并直接记录在区块链上的治理系统。上链提交需要用户为每张投票支付交易费用。 链下投票是指个人投票不作为区块链交易提交的治理系统。链下投票不需要交易费用。 从 Sunder 的角度来看,我们是链上投票和链下投票之间的桥梁,我们也定义了投票的价值,为链上投票带来更多参与,也让参与得到回报。 Can you share with us the plan for Sunder Protocol in the near future, especially your plan in the China market? 您能否与我们分享一下近期 Sunder Protocol 的计划,尤其是您在中国市场的计划? A: Given the first-mover advantage Sunder has in this DeFi niche, our targets thrive towards integrating with multiple Governance Protocols to become the backbone in this segment. The Chinese Market has several successful DeFi protocols we look forward to integrating with, to set up coverage on all fronts. Marketing and Integration with local partners is key to us for bootstrapping the right relationships with Chinese DeFi users, and catering to their needs. 答:鉴于 Sunder 协议在这个 DeFi 领域的先发优势,我们的目标是与多种治理协议集成,成为这一领域的支柱。 中国市场有几个成功的 DeFi 协议,我们期待与之整合,以建立全方位的覆盖。 与当地合作伙伴的营销和整合是我们与中国 DeFi 用户建立正确关系并满足他们需求的关键。 —- 编译者/作者:大橙子和小同的干 玩币族申明:玩币族作为开放的资讯翻译/分享平台,所提供的所有资讯仅代表作者个人观点,与玩币族平台立场无关,且不构成任何投资理财建议。文章版权归原作者所有。 |

治理3.0SunderProtocol用“拆分”重新定义治理代币价值

2021-06-10 大橙子和小同的干 来源:区块链网络

LOADING...

相关阅读:

- 609监管政策集中释放背后逻辑与未来发展如何?2021-06-10

- 马萨诸塞州参议员ElizabethWarren:国会和联邦监管机构是时候直面加密货2021-06-10

- BunnyPark大爆发:NFT赛道上暗藏的数十亿DeFi机会2021-06-10

- XCH、BTC、DeFi挖矿区别2021-06-10

- XT.COM火热开展第四轮“BZZ1认购”活动2021-06-10