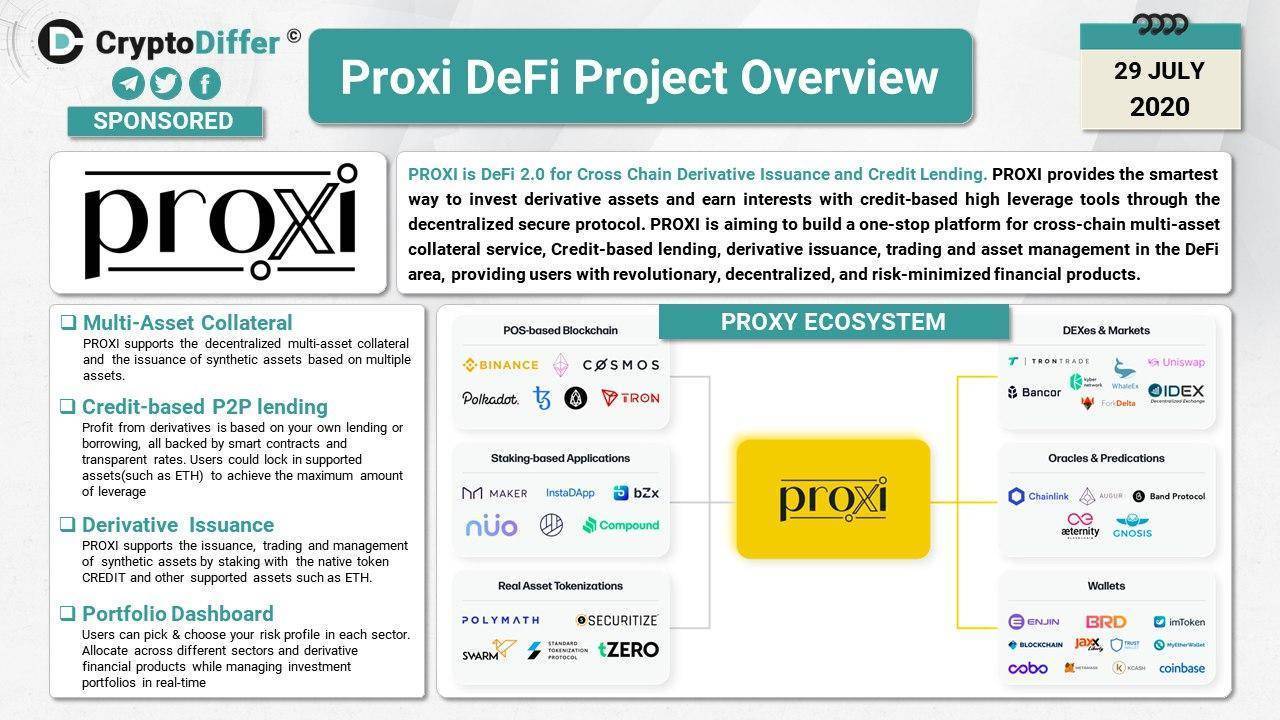

Hello everyone, thank you all for participating in the AMA. I am the gold host of Crypto Pavilion. “Accelerate the Transition to DeFi 2.0 with Credit and Derivatives‘“We have the honor to invite Paul, the head of marketing of PROXI, to discuss this topic with you. 大家好,感谢各位小伙伴参与AMA,我是加密阁的金牌主持人,今天AMA的主题是《用信贷和衍生品加速DeFi向2.0进化》。这个主题我们有幸邀请到了PROXI的市场营销负责人 Paul来跟大家探讨。 Welcome Paul 欢迎 Paul Let me introduce you to the PROXI project 我来介绍下PROXI 这个项目 项目:PROXI DeFi 网站:proxidefi.com WIKI:wiki.proxidefi.com PROXI是专注于信用借贷和跨链衍生品发行的第二代DeFi协议(DeFi 2.0)。PROXI将通过安全的开放式协议为用户和投资者提供最高效的途径参与衍生品投资和信用借贷,并使用户在专业金融工具的帮助下尽可能获益。 PROXI的使命是为用户提供跨链多资产抵押服务、信用借贷、衍生品发行和交易以及资产管理等为一体的一站式服务交互协议,致力于为用户提供和革命性、去中心化且金融风险可控的DeFi服务。 We start today's AMA,Are you OK ?@paul 我们开始今天的AMA,你准备好了吗 ,paul 1、Paul is the head of marketing at PROXI, please introduce yourself, including past experience in the financial and crypto realm. Paul负责PROXI项目的市场营销工作,首先请他简单介绍一个自己,包括从业经历等等。 Paul Jankovi?, Head of Marketing at PROXI Bachelors of Computer Science in the University of Manchester. Expert in IT and Technology across several multiple industries. With leading backgrounds in the diverse industries, including J.P. Morgan, HSBC and Accenture, I gravitated towards the blockchain-based Open Finance for years. The involvement with PROXI, the DeFi 2.0 for Cross Chain Derivative Issuance and Credit Lending, give me the chance to combine both my professional expertise and my personal passion perfectly. 曼彻斯特大学计算机科学学士学位,且为跨多个行业的IT和技术专家。凭借在摩根大通,汇丰银行和埃森哲等不同行业的专业背景,我多年来一直对基于区块链的开放金融兴趣浓厚。参与PROXI,用于跨链衍生发行和信贷的DeFi 2.0,使我有机会完美地结合我的专业知识和个人热情。 https://www.linkedin.com/in/paul-jankovi%C4%87-7557371b3/ 2、Why PROXI is so important for the crypto industry? Can you introduce it to the community? PROXI为什么重要?可以给大家介绍一下吗? PROXI is DeFi 2.0 for Cross Chain Derivative Issuance and Credit Lending. PROXI provides the smartest way to invest derivative assets and earn interests with credit-based high leverage tools through the decentralized secure protocol. PROXI是用于跨链衍生发行和信贷的DeFi 2.0。 PROXI通过去中心化的安全协议,为用户提供了最聪明的方式来投资衍生资产并利用基于信贷的高杠杆工具赚取利息。 The mission of PROXI is to build a one-stop platform for cross-chain multi-asset collateral service, Credit-based lending, derivative issuance, trading and asset management in the DeFi area, providing users with revolutionary, decentralized, and risk-minimized financial products.PROXI will release the user's reputation value,helping users maximize the user's capital utilization rate while meeting risk control conditions. PROXI的使命是为DeFi领域的跨链多资产抵押服务、基于信用的贷款、衍生产品发行交易和资产管理提供一个一站式平台,为用户提供革命性,去中心化和风险最小化的金融工具。PROXI将会帮助用户在满足风控的条件下尽量提升用户的资金利用率,释放用户的信誉价值。 ThisisapictureshowingtheProjectOverviewandeco-system.本图展示PROXI的项目信息以及生态体系

Official channels of PROXI are as below: PROXI的官方渠道如下: Website: https://proxidefi.com/ Official Medium: https://medium.com/proxidefi-blog Official Twitter: https://twitter.com/_ProxiDeFi Official Telegram: https://t.me/proxi_defi Official Discord: https://discord.com/invite/N6PUXVh Official Linkedin: https://www.linkedin.com/company/proxidefi/about/ Official Github: https://github.com/ProxideFi Wechat Official Accounts: ProxiDeFi 3、What do you think of the hot DeFi phenomenon and market opportunities? 请问您如何看待目前的DeFi领域的大热的现象和市场机会? DeFi has become the most promising growth area in the crypto industry. The amount of ETH locked in DeFi has been following an net-upward trend since mid-2019.In June 2020, Compound released its COMP governance token,releasing a complex yet highly lucrative mechanism known as Yield Farming.According to the data tracker website DeFi Pulse, the impact of the Yield Farming Frenzy on the Total Value Locked(USD) in DeFi has been tremendous, causing the TVL to reach an all-time-high of $3.03B. However, DeFi is still in its early stage, lacking sophisticated, valuable derivatives and Credit-based leverage tools to allow the investors to achieve the maximum amount of interests and yet pump up liquidity to the crypto world. DeFi已成为加密行业最有希望的增长领域。 自2019年中以来,锁定在DeFi中的ETH数量一直呈净增长趋势。2020年6月,Compound发布了COMP治理令牌,释放了一个复杂但利润丰厚的流动性挖矿机制,称为“收益农业”。 根据数据跟踪网站DeFi Pulse的分析,收益农业狂热对DeFi中的总价值锁定(USD)的影响是巨大的,从而使TVL达到了历史最高点的$3.03B。 但是,DeFi仍处于早期阶段,缺乏复杂的且有价值的衍生工具和基于信用的杠杆工具,无法使投资者获得最大的利益,但却为加密货币世界注入了流动性。这也是PROXI致力于为用户提供的服务:提供以信贷和衍生品为核心的开放式金融工具。 4、NextquestionHowdoesthePROXIplanrealizetheprojectplanwithcreditandderivativesasthecore?Pleaseintroduce. 下一个问题请问PROXI计划如何实现以信贷和衍生品为核心的项目方案呢?请为社区进行一下简单介绍。 PROXI is going to be built on the cross-chain technology such as polkadot, and will release the first MVP on Ethereum in the near future. The brief intro to the PROXI’s solution is as follows: PROXI将基于跨链技术构建如polkadot,并将在不久的将来在以太坊上发布首个MVP最小可行性产品。 PROXI解决方案的简要介绍如下: The blockchain architectures of PROXI contains four core modules, namely, Interoperability Layer, Decentralized Multi-asset Collateral Pool, Module for Credit Lending with High Leverage, and the Derivative Issuance and Trading Module. PROXI的区块链架构包含四个核心模块,即互操作性层,去中心化多资产抵押池,高杠杆信贷借贷模块以及衍生发行与交易模块。

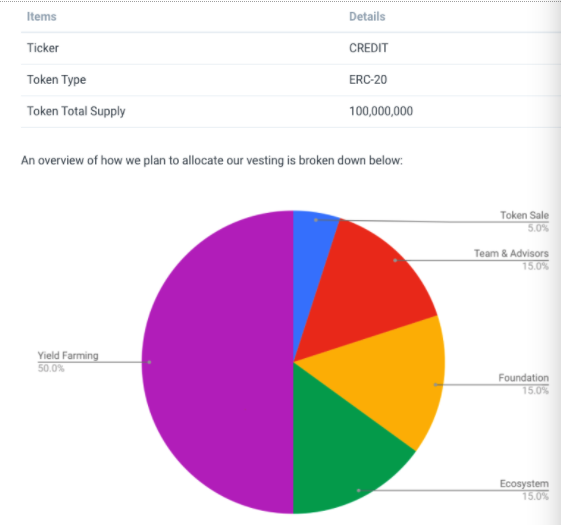

Please checke the wiki to find more related technology details: https://wiki.proxidefi.com/proxi-tech https://www.chainnews.com/articles/436414782907.htm 请查看官方技术文档获取更多技术细节: https://wiki.proxidefi.com/proxi-tech https://www.chainnews.com/articles/436414782907.htm 5、How is the PROXI token model designed? Whether to introduce a liquidity mining mechanism? 请问PROXI的代币模型是怎样设计的?是否引入流动性挖矿机制? Within the ecosystem of PROXI, there are two tokens functioning for different features respectively. CREDIT will be the utility token and PROXI will be the governance token. CREDIT is the capped supply ERC-20 token and will be issued soon via a series of Token Sale through multiple channels. CREDIT acts as the medium of payment and gas fees or commissions in the process of on-chain transaction, credit lending, asset issuance, trading, and other similar services. Fees will be partially burned, and partially extracted to the Collateral Pool as the Stabilization Fund to hedge the market risk. 在PROXI生态系统中,有两种分别用于不同功能的令牌,其中CREDIT将成为功能型令牌,PROXI将成为管理令牌。 CREDIT是上限固定的的ERC-20代币,很快将通过多个渠道通过一系列代币销售发行。 在链上交易、信贷借贷、资产发行、交易和其他类似服务过程中,CREDIT充当付款和gas费或佣金的媒介。 收取的手续费用将被部分燃烧,并部分提取到抵押池中作为稳定基金来对冲市场风险。

Besides, PROXI is going to adopt the liquidity mining incentive(so-called Yield Farming) to the multi-collateral and synthetic assets issuance operations.With Liquidity Mining Incentive plan, users could receive CREDIT token as rewards for adopting lending, borrowings, issuance and trading across the platform and thus the platform could go to market in an economic way and CREDIT token could have a native distribution throughout the ecosystem. For details, please stay tuned to official channels. 此外,PROXI将对多抵押品和合成资产发行业务采取流动性挖矿激励措施(即所谓的收益农业),通过流动性挖矿激励计划,用户可以获得CREDIT代币作为借贷和衍生品发行的奖励。通过这种方式,整个PROXI平台将能够更经济有效的方式进行市场推广。 有关详细信息,请持续关注官方频道。 6、How will PROXI tokens be distributed? How to participate? 请问PROXI的代币将如何分发?如何参与? The CREDIT tokens for tokensale will be distributed in 3 rounds including Community Round, DEX Round and IEO Round. 代币销售的CREDIT代币将分3轮分发,包括社区轮,DEX轮和IEO轮。 PROXI lovers will be able to participate the Community Round to claim CREDIT tokens by joining the official discord channel (https://discord.com/invite/N6PUXVh) and getting whitelisted right now. Here is detailed step-by-step guidance for the Community Round Tokensale. 通过加入官方Discord频道(https://discord.com/invite/N6PUXVh)并获得白名单,PROXI爱好者将能够参加社区轮以申领CREDIT令牌。 阅读以下文章中可以获得社区回轮代币销售的详细指南。https://www.chainnews.com/articles/511038667164.htm

请大家加入方Discord频道(https://discord.com/invite/N6PUXVh)并获得白名单 —- 编译者/作者:加密阁 玩币族申明:玩币族作为开放的资讯翻译/分享平台,所提供的所有资讯仅代表作者个人观点,与玩币族平台立场无关,且不构成任何投资理财建议。文章版权归原作者所有。 |

加密阁AMA - PROXI

2020-08-08 加密阁 来源:区块链网络

LOADING...

相关阅读:

- 投资 DeFi 代币之前,你需要知道的几件事2020-08-08

- 小贾言币:8.8以太坊行情分析2020-08-08

- 比特币市值再创新高;来说说银行和去中心化交易所那些不为人知的秘密2020-08-08

- CAL公链—引领Calorie大航海时代2020-08-08

- 澳洲最大数字资产交易所Royalcoin将推出平台币RLC2020-08-08