DeFi (decentralized finance) is quickly becoming a FinTech area of development and product distribution. In fact?DeFi?industry as itself really boils down to the cost of product distribution. The advent of mass internet use in early 1999–2000 brought costs of implementation close to zero for the content. However, in global world of finance the costs of creating financial products for everyone have not gone close to zero, yet. DeFi(去中心化金融)正迅速成为金融科技领域的产品分销管道。实际上,DeFi?行业本身就可以归结为是金融产品分销的管道。1999-2000年初,互联网信息的爆发使内容的发布与获取的成本接近于零。然而,在全球金融领域,为每个人创造金融产品的分销成本还没有接近于零。 这便开启了DeFi的潘多拉魔盒。 1. DeFi?促使以太坊价格暴涨 As USA continues their decade plus long initiative of near zero % interest rate to fuel USD based assets and financial markets, we are in era of quasi bubble in asset prices as well as living in depressed economies brought upon by global pandemic and weak economic inflation rates that have be government supported. China’s own central bank warned that the prolonged presence of ultra-low interest rates in some economies is storing up financial stability risks and causing spill over effects for other countries. As stated by their own central bank; “Low interest rates implemented in developed economies haven’t reached the desired effects,” as inflation levels have stayed below target for a long time, the People’s Bank of China said in its quarterly monetary policy report. Stated that low interest rates can hardly change structural issues in those economies, have worsened banks profit and caused credit tightening effects in some circumstances. So are we in?DeFi?bubble as well as generally found in global economy? 随着美国未来十年将长期采取近零利率的举措来推动以美元为基础的资产和金融市场,我们正处于资产价格准泡沫的阶段,并且全球流行病的爆发(Covid19)和疲软的经济通胀率所带来的低迷经济使得美国政府被迫维持现在的状态。中国央行警告说,某些经济体长期存在超低利率正在积蓄金融稳定风险,并给其他国家造成溢出效应。中国人民银行在其季度货币政策报告中表示,“由于发达经济体的通货膨胀率长期以来一直低于目标,因此发达经济体实施的低利率尚未达到预期的效果。”?指出低利率几乎无法改变这些经济体的结构性问题,在某些情况下已经恶化了银行的利润并造成了信贷紧缩效应。那么,我们是否正处于DeFi?泡沫以及全球经济普遍存在的泡沫中? Even with possible bubbles around DeFi, the community continues to draw attention from crypto traders and mainstream media as well as founders whom continue to build out their projects. Different applications have come into the spotlight after?Compound?project first came into industry knowledge and awareness. Crypto industry as whole continues to view the biggest issues are token valuations and a lack of understanding among participants of their risks. These risk have occurred this year with hackers abusing DeFi products and finding technology loophole weakness in order to steal from their platforms. In this past June and April, a hacker drained approximately $500,000 from DeFi service Balancer and $25 million was stolen from dForce respectively. Ignoring the risks involved, the?DeFi?industry continues forward without a hitch. 即使DeFi 行业可能存在泡沫,整个加密社区仍继续吸引加密交易商和主流媒体以及开发者和各行业创始人的关注。在复合项目首次进入行业知识和意识后,不同的应用程序已成为人们关注的焦点。整个加密行业仍然认为,最大的问题是象征性的估值和参与者对其风险缺乏了解。这些风险发生在今年,黑客滥用DeFi产品,发现技术漏洞和弱点,以便从他们的平台上窃取。在刚刚过去的6月和4月,一名黑客分别从DeFi Service Balancer和Dforce窃取了大约50万美元和2500万美元。然而,社区无视所涉及的风险,DeFi 行业继续顺利前进。 The interest in DeFi was initialized with growth of?Compound?lending platform launching their COMP token. There was also a concerted awareness and industry push towards decentralized lending services as well as “yield-farming.” DeFi’s popularity and investor interests has been surging recently this past year time frame. The total number of DeFi users over time is edging towards estimate of 600K in June 2020, according to Ethereum (ETH) analytics platform Dune Analytics (Fig 1), below shows ETH price changes, percent % wise in $USD, for year to date time frame(12/31/19–08/31/20). Aside from March lows stemming from global pandemic market reactions, ETH prices changes in $USD have been in a range. This can be infer to mean ETH supply in open markets might be moving into staking and?DeFi?platforms and less likely be short term and intraday traded. This ETH % movements can also mean that there is more demand to own it because of?DeFi?platforms. 对DeFi?的兴趣是随着复合借贷平台推出其Comp令牌的增长而产生的。人们还一致认识到,行业正在推动分散的贷款服务和“Yield-farming”。在过去的一年里,DeFi的人气和投资者的兴趣一直在飙升。根据以太坊(ETH)分析平台Dune Analytics(图1)的数据,到2020年6月,DeFi?用户总数预计将达到60万。以下显示了年初至今(12/31/19–08/31/20)期间ETH价格的变化,以美元%为单位计算。除了全球市场连锁反应导致的3月低点之外,美元对ETH价格变化一直在一个范围内。这可以被推断为意味着在公开市场上的ETH供应可能会进入Stacking和DeFi?平台,而不太可能是短期和日内交易。由于DeFi?平台,ETH %的变动也意味着有更多的需求来拥有它。

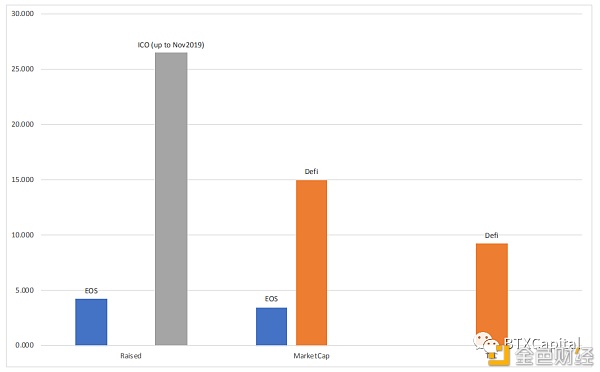

图1 Data from Dune Analystics There have been enormous $USD percent capital gains among the decentralized finance (DeFi) tokens which have been compared to the 2017 initial coin offering (ICO) craze and phenomena. In (Fig 2) , shows some sparse data sets that gives some perspective on size of $USD involvement in ICO raises, EOS project was largest ICO raise of $4.2 billion.DeFi? relative market capitalization is around $15 billion and with about $9 billion locked up. ICO projects have raised $25 billion since inception up to Nov, 2019 data. Interesting note here is?DeFi?was a recent industry movement then ICO industry scene which debuted sometime in 2017. 与2017年首次代币发行(ICO)热潮和现象相比,去中心化金融(DeFi)代币带来了巨大的美元占比的资本收益。在(图2)中,显示了一些稀疏的数据集,给出了一些关于美元参与ICO融资规模的观点,EOS项目是最大的ICO融资,为42亿美元。DeFi的相对市值约为150亿美元,其中约有90亿美元被锁定。截至2019年11月,ICO项目自成立以来已筹集250亿美元。有趣的是,DeFi是最近的一年的行业运动,而ICO行业场景是在2017年的某个时候推出的。

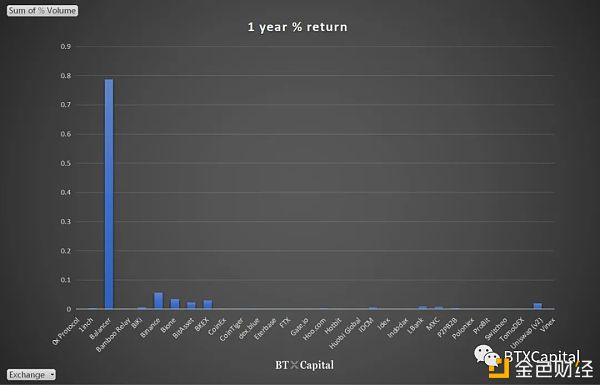

图2 Data From CoinMarketCap The 2017 ICO scene saw several hundreds of token launches in which the assets, majority wise via Ethereum blockchain. There were about 435 ICO projects “listed” with average raise of roughly $12.7 million, for a total of USD 5.6 billion. Financial news outlet, CNBC had reported the ICO capital raises which mired the amount of money raised through ICOs had surpassed “…early-stage venture capital funding for internet companies….” Legal and regulators were very vehemently open about risks and illegal financial securities being issued. In February of 2019, U.S. Securities and Exchange Commission (SEC) would create guidelines that would provide enforcement against ICO projects due to securities law violations. 2017年的ICO场景见证了数百次代币发行,其中大部分资产是通过以太坊区块链发行的。约有435个ICO项目“上市”,平均融资约1270万美元,总计56亿美元。美国全国广播公司财经频道(CNBC)曾报道称:“ ICO作为早期项目融资通道已经超过了风险投资基金投资的最大金额。”法律和监管机构对ICO公开募集行为进行了监管。2019年2月,美国证券交易委员会(SEC)将制定指导方针,对违反证券法的ICO项目进行执法。 The ICOs phenomena and DeFi products have investors both experiencing capital appreciation of assets such as?Compound’s COMP governance token and via the actual use of DeFi, i.e. yield farming. The total capital locked in various DeFi platforms has risen from roughly USD 1.1 billion to 9.2 billion year to date (Fig 2). With the exception for the leading?MakerDAO, have seen incredible price appreciations this year such as?Compound’s COMP governance token saw nearly 5x gains in the first few days after its launch in mid-June and has $763M locked in its Defi platform. A project with a protocol?Aave’s LEND token has seen over 6x gains from the end of May with $1.2B locked up. Another project called?Synthetix’s SNX token has also seen an over 5x increase since the end of May with $833M locked up. See (Fig 3), graph, the price increases on a percentage wise scale from the more popular Defi related tokens have outpaced the general financial index such as SP500 over 1 year time frame. Even with rapid upward pricing movements of “FAANG” stocks, Tesla, the collection of Defi tokens still had outsized percentage price increases. The surge in DeFi projects and staking is one of many reasons for ethereum’s (ETH) ongoing pricerally, which has seen estimate ~70% increase, from $225 on June 30 to nearly $500( Sept 1, 2020) price range points (Fig 4). DeFi represents Ethereum best use case so far and points to increasing usage of the network year to date for 2020, (Fig 5). ICO现象和DeFi产品使投资者既经历了资产的资本增值,如Compound的Comp Governance Token,又通过实际使用DeFi,即“Yield Farming”。到目前为止,锁定在各种DeFi平台的总资产TVL已从大约11亿美元增加到92亿美元(图2)。除了领先的MakerDao之外,在今年6月中旬推出之后的头几天,Compound的COMP治理令牌就获得了近5倍的收益,并锁定了7.63亿美元的DeFi平台。自5月底以来,AAVE的Lend Token协议的一个项目已经获得了超过6倍的收益,锁定了12亿美元。自5月底以来,另一个名为Synthetix s SNX Token的项目也实现了超过5倍的增长,锁定了8.33亿美元。参见(图3),从图中可以看出,在一年的时间框架内,更受欢迎的DeFi相关代币的价格涨幅超过了一般金融指数,如SP500。尽管“FAANG”股票的价格迅速上涨,但如Tesla、DeFi代币的价格涨幅仍然领先。DeFi项目和投资的激增是以太坊(ETH)持续走高的众多原因之一,从6月30日的225美元到接近500美元(2020年9月1日)的价格范围点(图4),估计增长了约70%。DeFi代表了到目前为止以太坊的最佳使用案例,并带动了2020年迄今为止网络使用量的增长(图5)。

图3 Data from BTX Capital

图4 Data from BTX Capital

图5 Data from BTX Capital 2 .? “有趣的”项目方 The project was made aware that anonymous developer created smart contracts and around 80,000 CRV tokens were reportedly pre-mined before the?Curve?team verified the deployment. The team members at Curve was initially “skeptical,” but eventually discovered that the deployment had “correct code, data and admin keys.” Interesting enough,?Curve?project has continued business as usual and it seems embrace this change in project planning. 据报道,在Curve团队验证部署之前,匿名开发人员创建了智能合约,大约有80,000个CRV令牌(约500万美金)被预先挖掘。Curve的团队成员最初“持怀疑态度”,但最终发现部署具有“正确的代码、数据和管理键”。有趣的是,Curve 项目继续照常运营,而且似乎在项目团队接受了这一“被”预挖的结果。 “Due to the token and DAO getting traction, we had to adopt it,” said?Curve, adding: “The launch has happened.” The early pre- launch of?Curve’s DAO and CRV token has been viewed by DeFi industry with skepticism and concerns for fraudulent endeavors. The technical essence in nature of permission-less blockchain networks means any developer can deploy smart contract codes. Various Cryptocurrency exchanges such as Binance, OKEx and Poloniex, have supported the sudden launch of CRV token. “由于代币和DAO越来越受欢迎,我们不得不采用它,”Curve说,并补充道:“代币最终还是按原计划发行。”DeFi行业对Curve的Dao和CRV令牌的早期预挖持怀疑态度,并担心会出现欺诈行为。无许可区块链网络意味着任何开发者都可以部署智能合约代码。Binance、OKEx和Poloniex等各种加密货币交易所支持了CRV Token的的上线。 There are technology risks involved in DeFi projects and example of this would be Yam Finance, an experiential Decentralized Finance protocol. The Yam project saw its market dollar cap crash to zero within minutes on August 13, 2020. The crash of YAM market value which caused price volatility to suddenly increase for all of the major DeFi tokens such as Compound, Yearn Finance and Balancer. On twitter, Yam co-founder Brock Elmore reveal that their project’s protocol had a fatal technical bug that rebase supply feature of Yam tokens. This technical flaw caused governance system issues of the protocol by rebasing and following the initial rebase would mint more YAM tokens than intended. Yam had staking pools for Compound, Aave’s Lend, Chainlink’s Link, Wrapped ETH, YFI, Synthetix, Maker, and Uniswap V2 LP tokens which all had pricing corrections in DeFi trading markets when rebasing bug was known. Systemic risks in DeFi markets are also an area of concern when multiple token projects are tied together as such in staking processes. DeFi 项目涉及技术风险,例如YAM Finance,这是一种体验式去中心化金融协议。2020年8月13日,Yam 代币价格在几分钟内跌至零。YAM市场价值暴跌,导致所有主要代币(如Compound、Zone Finance和Balancer)的价格波动性突然增加。Yam联合创始人Brock Elmore在Twitter上透露,他们项目的协议存在一个致命的技术缺陷,即Yam令牌的Rebase供应功能。这一技术缺陷导致了协议的治理系统问题,因为在最初的重新定基之后,会产生比预期更多的YAM代币。YAM曾为Compound,Aave的贷款,Chainlink的Link,Wrapped ETH,YFI,Synthetix,Maker和Uniswap V2 LP代币投入大量资金。当多个代币项目在下注过程中被捆绑在一起时,DeFi市场的系统性风险也是一个值得关注的领域。 3 . 监管未至 DeFi will eventually draw regulators out of woodwork and have more oversight towards the space. There will be inevitably invite difficult legal questions and regulatory scrutiny. For example, Synthetix is going offer token like equities for Tesla and Apple stock which can potentially cause some legal issues. SEC enforcement ended ICOs in USA and created more legal oversight in other countries. Given the legal precedent for ICOs, DeFi investors should exercise caution while seeking this kind of investment exposure. Further discussions and deep dive legal analysis is needed for self-regulatory approaches to identifying DeFi projects with best practices on platform security, financial token design, and proper legal structures. There will also be need for legal professionals to help in deciding what regulatory bodies will need to be involved, lobbying parties, DeFi funds for lobbyists, and other initiatives that will try to defend and educate the real world benefits that these cryptocurrency based technologies are trying to provide. DeFi最终将吸引监管者的关注,并对行业进行更多监督。不可避免地会有棘手的法律问题和监管审查。例如,Synthetix 将为特斯拉和苹果股票提供类似股票的代币,这可能会引发一些法律问题。美国证券交易委员会的执法终结了ICO,并在其他国家建立了更多的法律监督。鉴于ICO的法律先例,DeFi投资者在寻求此类投资机会时应谨慎行事。需要进一步的讨论和深入的法律分析,以自我监管的方法来识别具有平台安全最佳实践的DeFi项目,金融代币设计和适当的法律结构。还需要法律专业人员来帮助确定需要参与哪些监管机构,DeFi为游说者和其他倡议提供资金,这些倡议将试图捍卫和教育这些基于加密货币的技术,最终实现现实世界的的利益。 DeFi tokens today follow some themes that have help it gain traction these days. The most popular theme for DeFi project launches have been those that follow, lending protocols and on-chain derivatives platforms. The project valuations on these themes have recurring simple yields and characteristics. With relative ease, new DeFi products and services can be launched and traded into exchanges via trading crypto markets, has caused some alarms of makings of asset bubble. 今天的DeFi代币遵循了一些主题,这些主题已经帮助它们持续的获得了关注。DeFi项目启动最流行的主题是:借贷协议和链上衍生平台。这些主题的项目评估具有重复的简单收益和特征。相对容易地,新的DeFi产品和服务可以通过加密货币市场进行交易并交易到交易所,这引起了资产泡沫形成的一些警报。 DeFi Market, with no restrictions or oversight can create innovation and growth of newly founded financial technology applications. The practice of yield farming from DeFi project have decentralized the financial investment application by removing middleman of finance world, banks. DeFi projects can be created and listed on decentralized exchange such as?Uniswap?with very little barriers to entry or friction. But when a DeFi project list a 10% yield annual return on a token $ USD asset that can fluctuate in price too often; this can lead to investment bubble-like situations. 没有任何限制或监督的DeFi市场,可以为新成立的金融技术应用程序创造创新和增长。DeFi项目的Yield Farming实践通过去除金融世界、银行的中间人,分散了金融投资管道。DeFi项目可以创建并在UNISWAP等去中心化的交易所上市,几乎没有进入障碍或摩擦。但是,当一个DeFi项目列出10%的没用年收益率时,且价格剧烈的波动,那其实泡沫不经意间就在增加。 Vitalik Buterin quote; “Honestly I think we emphasize flashy DeFi things that give you fancy high interest rates way too much. Interest rates significantly higher than what you can get in traditional finance are inherently either temporary arbitrage opportunities or come with unstated risks attached.” Vitalik Buterin:“老实说,我认为我们在强调华而不实的东西,DeFi给你太多的高利率。这些高利率明显已经高于你在传统金融中所能得到的,本质上要么是暂时的套利机会,要么是伴随着未提示的风险。” 4.?DeFi?的前景 On contrary DeFi network protocols are being used as utility tokens, in which they do have some kind of functional mechanics that gives them valuation and usage. DeFi might seem less interesting to those that don’t follow crypto industry or retail?Robinhood?stock investors whom learned hard lesson from their past investments in ICO tokens. DeFi projects due to its complex technical structure, is very likely to suffer from high volatility and sudden price drops. Only DeFi projects that have real business and technical sophistication in nature will surpass and grow more so than your average ICO tokens from 2017. Sound and well thought out DeFi projects probably will still not get average investors to buy into ecosystem and would limit non qualified investors due to geographical location. DeFi protocol projects that create real world economic value will thrive and become industry leaders. Projects whom just reuse and recycle trading arbitrage gains for speculators will enjoy their short term financial success. We should get ourselves comfortable with that fact. Future token price volatility and market corrections can only strengthen DeFi mass adoption perspectives if industry continues to build and stop worrying about yields. 相反,DeFi网络协议却在被广为使用,其中它们确实具有某种功能机制,可以赋予其评估和使用价值。对于不追随加密货币行业或 Roinhood 上股票投资者的用户来说,DeFi似乎不太有趣,他们从过去对ICO代币的投资中汲取了深刻的教训。DeFi项目由于其复杂的技术结构,极有可能遭受高波动性和突然的价格暴跌之苦。从本质上讲,只有具有真正业务和技术水平的DeFi项目才能超越现在并增长,超过2017年以来的ICO代币。经过深思熟虑的DeFi项目可能仍不会吸引普通投资者来购买它的令牌,并因地区监管问题,会限制不合格的投资者。最后,创造真实世界经济价值的DeFi协议项目将蓬勃发展,并成为行业领导者。只为投机者重用和交易套利收益的项目将获得短期的财务成功。我们应该对这个事实结果感到满意。如果DeFi行业继续且已经消化了高收益泡沫,那么未来代币价格的波动和市场修复调整会加强DeFi被更广泛的使用及接受。 原英文版本已发布于BTX Capital Medium:https://medium.com/@btx.capital/is-defi-movement-the-next-ico-craze-2e3cb851290a 「转载请注明出处」 —- 编译者/作者:VanessaCao 玩币族申明:玩币族作为开放的资讯翻译/分享平台,所提供的所有资讯仅代表作者个人观点,与玩币族平台立场无关,且不构成任何投资理财建议。文章版权归原作者所有。 |

DEFI运动是下一个ICO热潮吗?

2020-09-15 VanessaCao 来源:区块链网络

- 上一篇:道氏论币:9.15BTC晚间行情多单进场

- 下一篇:BTC晚间行情策略:

LOADING...

相关阅读:

- 法国巴黎银行运用DAML智能合约与顶尖证券交易所建立联系2020-09-15

- 酸黄瓜已添加到DeFi菜单中2020-09-15

- 自年初以来,Tether已向USDT用户返还了500万美元2020-09-15

- 继YFII之后YFI再次遭遇分叉 YFI社区分叉代币YFIG即将空投2020-09-15

- 黑洞资本斥资千万美金打造BHT公链,进军DEFI领域2020-09-15